The Challenges

Tariffs

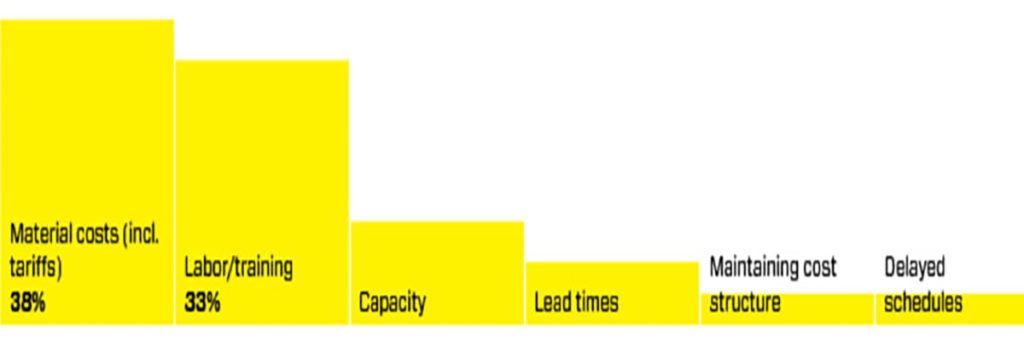

Rising material costs were the number one challenge for Top Metal Companies this year, even surpassing the labor force shortage. Many respondents identified the metal tariffs, 25 percent on steel and 10 percent on aluminum, as the main source of the increase.

“Material prices rose with the potential of tariffs,” says Tom O’Malley, partner, Clover Architectural Products. “This increase was not small and caused many projects to have budget issues or to not go forward. It also caused longer lead times as domestic suppliers had more customers coming to them who normally would source their metal from overseas.”

Respondents characterized the current market as uncertain. “Due to the tariffs, pricing has escalated at an unprecedented rate,” says Mike Wallace, president, Quality Metalcrafts LLC/Americlad. “It’s difficult to keep up.”

President Donald Trump imposed the original tariffs through an executive order signed in March 2018, affecting imports from the U.S.’s trading partners, including Mexico, the European Union and Canada. In September, the administration imposed additional tariffs on $200 billion of Chinese imports, including glass. Read more about the tariffs.

To weather the volatile market, several Top Metal Companies report they are changing pricing structures and increasing communication with the supply chain. “We’re addressing the issue by sourcing new suppliers, securing commitments from existing suppliers and communicating clearly about rising material cost reasons with trade customers so they will understand any necessary, modest price increases,” says Davidson Chen, sales manager, Gamco Corp.

Labor

The industry’s labor force continues to stagnate, according to Top Metal Companies survey respondents. For the third consecutive year, respondents point to recruiting skilled labor as a top concern.

To overcome the impacts of the labor shortage, companies continue to innovate in recruitment pathways, teaming with employment and temp agencies, as well as local schools, to attract employees to the industry, according to survey respondents. “There is limited available talent,” says Jacob Gaddis, director of preconstruction, United Architectural Metals. “In order to work through [the skilled worker shortage] we have teamed up with local universities to expose the students to our industry.”

A historically low unemployment level—down to 3.9 percent in September of this year, according to the Bureau of Labor Statistics—has further exacerbated labor issues. “Unemployment rates continue to be extremely low throughout the country,” says Mary Avery, vice president of marketing, Tubelite Inc. “It is increasingly difficult to locate and retain strong employees. We see turnover and associated costs rising as well as pay scales.”

Many companies did report increasing wages in order to attract workers from a limited labor pool. Companies also continued to cultivate current employees through a focus on company culture and schedule flexibility. “We are still working through the challenges [of the tight labor market],” says Lisa Britton, director, sales and marketing/sustainability champion, Industrial Louvers Inc. “In the meantime, we have encouraged our employees to work overtime and have been flexible with schedules so that we can take the hours they’re willing to give.”

The Trends

Compiled by officials from building envelope specialty contractor IWR North America.

Thermal performance. “[There is] increased awareness and focus on thermal design requirements of buildings and the integration of continuous insulation requirements into building design. Specifically, [there is a focus on] the design and application of the insulation, and the air and vapor barrier systems behind our cladding, as well as the integration of penetrations/perimeter conditions of these constructions.” —Sean Hamlin, senior estimator

Pre-fab systems. “Due to limited space on jobsites coupled with compressed project schedules, we are always looking to pre-fabricate or pre-assemble as much of an enclosure system or component as we can offsite. Unitizing support systems or entire façade components provides benefits on many levels.”

—Eric Youngblood, director of project management

Shapes. “Unique patterns and shapes incorporated into the façade design, likely influenced from European trends. With these trends, we are seeing an increase in Europe-based manufacturers and suppliers, adding further dynamics to the equation.”

—Mark Worrell, estimator

Fire protection. “Recent international incidents have caused increased awareness for building codes within the United States, specifically NFPA-285. With the added dynamic of custom façades and enclosure designs, ensuring compliance of the designed assemblies requires time, resources and coordination.”

—Michael Smalley, preconstruction manager

Large panels. “[We’re seeing an] increasing desire from the architectural community for large metal panel modules within the façade design. This demand is putting pressure on designers, engineers and manufacturers to deliver large panels while maintaining deflection, finish and performance criteria.”

—Sage Lehr, engineering manager

Standout design. “Extruded aluminum products and systems are being designed by architects as visual elements on the façade. For example: directional ‘fins’ integrated with multiple components within the façade.” —Dennis Papke, director of estimating

Woodgrain finish. “Architectural features such as entry portals, directional fins and soffits are being designed with a woodgrain finish.” —Papke

Bold colors. Architects are specifying “accents of expressive colors, typically over a gray or silver base color, using metal products and systems.” —Worrell

Lighting. “More lighting elements [are being] integrated with the façade components. For example: up-lighting built into facades and architectural systems that house LED lighting, to provide a unique feature to the façade.” —Worrell